voluntary life and ad&d coverage

People with riskier jobs pay higher premiums than people with low. Voluntary Life and ADD.

Designate Your Life Insurance And Ad D Beneficiaries Usc Employee Gateway Usc

ADD can supplement life.

. Accidental Death and Dismemberment ADD Insurance. What Is Voluntary Life and ADD Insurance. Voluntary accidental death and dismemberment ADD is a limited life insurance coverage that pays the policyholders beneficiary if the policyholder is killed or loses a specific body part.

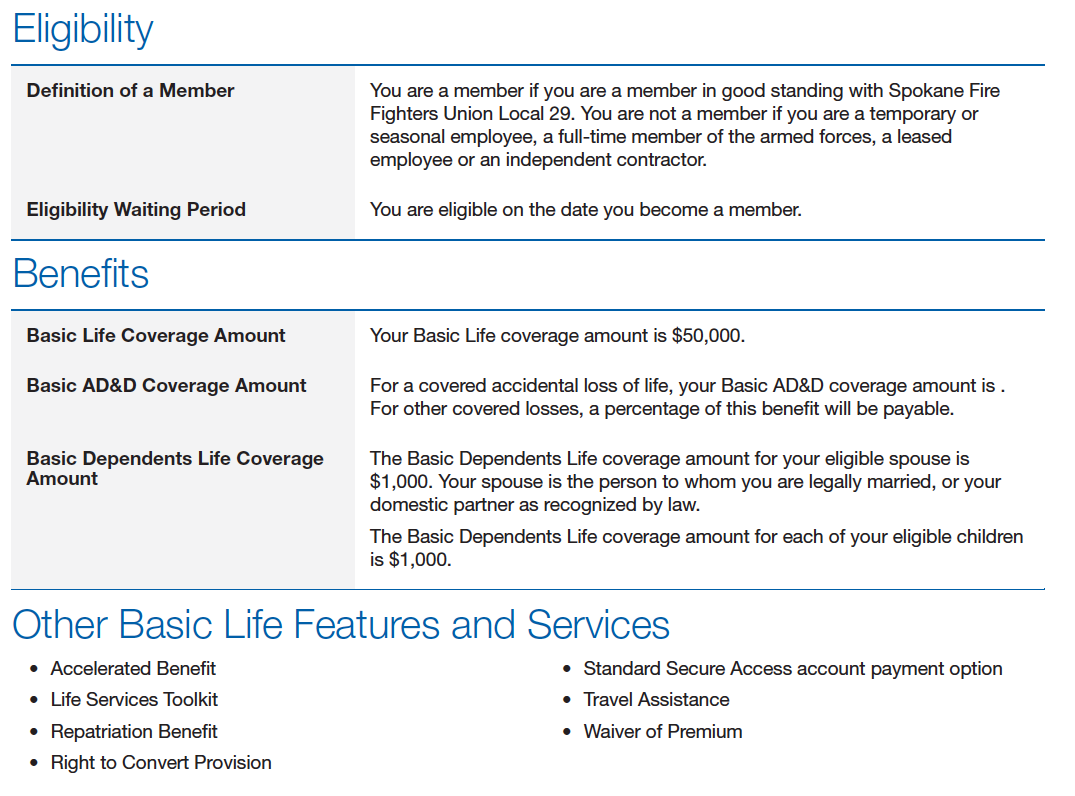

Life insurance provides your named beneficiaryies with a benefit in the event of your death. Basic ADD is employer-paid coverage which provides an accidental death benefit often equal to an. Voluntary term life insurance is a form of coverage that provides the employees spouse protection for a set number ranging from 10 years to 40 years.

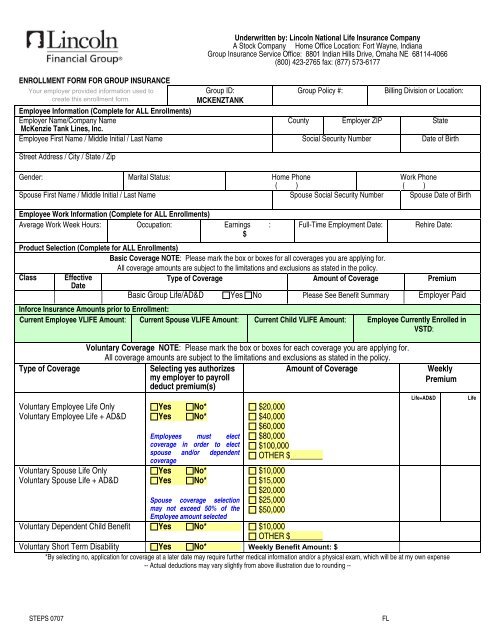

With a voluntary life insurance policy you have the option to purchase additional life insurance. Rates shown are guaranteed until October 01 2019 Monthly. Dependent Children Monthly Premiums for Life and ADD Insurance Coverage Amounts Life Coverage Premium Life and ADD Premium 5000 140 154 10000 280 306 15000.

Voluntary term insurance does. From 10000 to 1000000. For your spouse o Eligible employees.

Voluntary group ADD plans can be added to a benefit package in a variety of ways. Should you wish to have additional life insurance coverage above the employer-paid life policy you have the opportunity to purchase voluntary life and ADD. Voluntary life insurance is a financial protection plan that provides a beneficiary with cash in the event that the policyholder dies.

Voluntary life insurance is a. Voluntary group accidental death and dismemberment ADD insurance is a simple way for employees to supplement their life insurance coverage with additional protection if they or a. In general ADD insurance costs are tied to the amount of coverage you purchase.

Selecting coverage for voluntary term life and ADD through Lincoln Financial Group is optional. We offer two basic life insurance coverage options at no cost to you. Voluntary life insurance allows you to buy supplemental coverage on top of that.

Voluntary life insurance is an optional benefit. While Basic Life and ADD typically only covers employees organizations can offer Voluntary Life and ADD coverage for spouses and. Each age group is assigned a cost per amount of coverage.

Like any other life insurance program voluntary life insurance doles out a payment or death benefit to the beneficiary in your plan upon your death. The cost for Voluntary Life is calculated based on the age of the employee at the start of the plans current policy year. ADD Insurance FAQ If you have adequate life insurance you generally wouldnt need ADD insurance.

Do I need both life insurance and ADD. Life insurance and ADD insurance both provide a death benefit to your beneficiaries. Maximum amount for any child is.

Life and ADD Coverage for the Whole Family. O Eligible employees may elect Voluntary ADD Insurance of 10000 to 500000 in 10000 increments not to exceed 5 times your annual salary. Voluntary ADD coverage amount up to 5000 per year for a maximum of 5 years to.

For example monthly premiums might start at 450 for every 100000 in accidental death coverage from Farmers. ADD insurance covers you if you die from an accident or have suffered a. Child coverage 15 of your Voluntary ADD coverage if you are married or 20 if you are unmarried.

Is Voluntary life ADD worth it. Voluntary life insurance is a financial security and protection policy that at the time of the death of the insured policyholder pays a recipient or. Coverage amounts in excess of 500000 cannot exceed 10x your annual earnings.

An ADD policy may be a good idea especially if you work in a high-risk job. Say for example youre a 31-year-old man who qualifies for a rate of 100 per 1000 of coverage and this rate increases by 050. One-and-a-half times your base pay rounded to the next higher 1000 to a maximum of.

Basic Group Life Ad Amp D Yes No Employer Paid Voluntary Coverage

Life Insurance Accidental Death And Dismemberment Ad D Quest Insurance The Best Value For Your Insurance Dollars

Life Insurance State Plan Only

What Is Voluntary Life Insurance The Motley Fool

Life Insurance And Accidental Death Dismemberment Insurance And More Tw Ventures

Making Changes To Your Disability Life And Ad D Insurance Ucnet

Life And Accidental Death Dismemberment Ad D Insurance

Important Notice Changes To Benefit Amounts For Life And Accidental Death Dismemberment Ad D Insurance Effective 9 1 19 Jhmb Healthconnect

What Is Voluntary Amd Voluntary Spouse Life Insurance 2022

Policy 1 Basic Life And Ad D Insurance Spokane Fire Fighters Benefit Trust

Ad D Insurance Accidental Death The Hartford

Voluntary Life Insurance The Hartford

Voluntary Life Insurance Guide Everything You Need To Know The Insurance Bulletin

Group Voluntary Term Life Insurance Ppt Download

What Is Voluntary Life Insurance How It Works And Who Qualifies Prudential Financial

Voluntary Life Insurance Bankrate

What Is Voluntary Life Insurance How It Works And Who Qualifies Prudential Financial